Perspective |

Blog

With gold sitting near all-time record-highs, we are seeing some very strange events occurring in the numismatic marketplace. One of the more subtle, but numismatically significant occurrences that make $4,000 gold a net positive is the near total obliteration of the Market Premium Factor (MPF) for coins that are scarce but not truly rare.

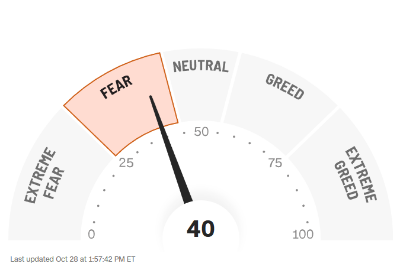

According to the Fear & Greed Index, low grade fear is the dominant emotion controlling the markets presently.

What is your biggest fear when it comes to investing?

Most investors might say they fear a massive stock-market crash.

But in the real world, the much bigger risk to retirement plans and portfolios is the slow, silent killer of investment returns: inflation.

So, why are so many investors and analysts afraid of the recent drop in silver and gold?

Silver saw the steepest single day downturn in six months, declining more than 6% from its recent record high above $54 per ounce. How spooky!

Like most fears, when you turn the light on... it's actually quite silly.

And any reactionaries should feel sheepish in the coming weeks.

First, this drop was easily anticipated.

No investment can rally forever.

Silver and gold have been on a massive tear for months, and a correction and consolidation was expected, warranted, and necessary in order for these assets to continue their bull market run.

Second, gold and silver dipped, then recovered, and are down again, but they haven't continued to plummet.

This was just a jump scare.

More importantly, these key fundamentals are still in place:

- Silver's gains YTD remain substantial (58%)!

- Industrial demand remains strong (up 4% in 2024, reaching a new record high for the 4th consecutive year)

- Supply deficits are worsening (187.6 million oz. forecast for 2025, growing for the 5th consecutive year)

- Geopolitical chaos is encouraging safe-haven bullion buying, and we don't see that ending any time soon...

If you allow the boogeyman of a temporary correction to scare you this badly, you shouldn't be investing in silver.

After all, the long-term outlook of silver as an asset for wealth protection remains unchanged.

And the bull market in precious metals has a long way to run.

Maintaining perspective amid periodic corrections is essential. The only thing you should be afraid of is missing out.

This week only: Take advantage of our exclusive pricing on 100 oz. Silver Bars at just $0.79 over spot. As a bonus, we're offering FREE SHIPPING and a FREE 1 oz. Silver Eagle when you buy 3!

Claim your silver bars now—call ASI at 1-800-831-0007 or email us today.

Gold and silver are pulling back right now, but this comes on the heels of an incredible rally.

Silver has been hated and ignored for decades.

Many failed to see the potential in gold's little sibling.

But the silver market is finally attracting significant attention — not just from retail and institutional investors, but also from mainstream outlets.

The silver market is up nearly 86% so far this year.

And according to the Silver Institute, the silver supply deficit is forecast to reach around 187.6 million ounces.

Should this trend persist, it would mean five consecutive years of annual deficits, amplifying supply-side pressures.

Meanwhile, geopolitical tensions, particularly between the U.S. and China, continue to drive global market volatility, driving demand for physical precious metals.

The current U.S. government shutdown is further contributing to uncertainty in financial markets.

Although silver has recently paused just below $53 per ounce, market fundamentals suggest this is a just temporary consolidation.

The best is yet to come for precious metals.

This week only: Take advantage of our exclusive pricing on 10 oz. Silver Bars at $0.99 over spot.

Claim your share now—call ASI at 1-800-831-0007 or email us today.

Now that gold is trending mainstream, it is important to understand why bullion bars and coins are by far the best way to own gold.

Silver just shattered the $50 per ounce barrier.

It blew past all previous highs, sending a clear message...

the precious metals market is on fire.

Up 68% year-to-date, 2025 stands as the most explosive silver rally since 1979.

But this momentum isn’t cooling off—it’s picking up speed, already above $52.

September alone was electric, driving prices up another 15%. The fuse is lit by unstoppable forces:

- Soaring demand from cutting-edge industries

- A relentless five-year global supply deficit

- Fierce profit motive

Silver’s smaller market punches hard—every dollar move hits with outsized impact.

With gold cracking $4,000 and pricing many out, silver is becoming the lightning rod for serious investors hunting real opportunity.

Its lower entry point compared to gold is pulling in a surge of new investors, each racing to ride the historic 2025 bull run before the next leg up.

History shows silver outmuscles gold in raging bull markets—think 2020: gold up 26%, silver up 48%!

In the epic 2001–2011 surge, silver exploded 1,000% off its lows while gold made headlines at 650%.

Bottom line: silver’s run is nowhere near finished.

If you’re waiting, you’re risking missing one of the biggest plays of this decade.

Claim your share now—call ASI at 1-800-831-0007 or email us today.

This week only: Take advantage of our exclusive pricing on 1 oz. Silver Buffalo Rounds at $1.59 over spot.

Silver has been obtainable at rather low premiums for months now, but rising spot prices are starting to draw attention, and premiums are on the rise!

Your portfolio is facing challenges from depreciating asset values.

This government shutdown could be different – and not in a good way.

The potential economic impacts may be downright dangerous.

Historically, government shutdowns have created political turmoil in Washington, D.C., but their economic effects have typically been limited and quickly reversed. Even the protracted 35-day shutdown of 2018-2019 resulted in few lasting consequences for U.S. financial markets.

However, the current landscape in 2025 is markedly more precarious.

- The labor market is faltering

- Proposed federal workforce reductions are compounding uncertainty.

- The stakes are considerably higher

This shutdown is introducing additional disorder, disrupting an already fragile environment.

Moreover, it will likely postpone the release of critical economic data—including upcoming employment reports and key inflation indicators. This may leave business leaders, investors, and Federal Reserve policymakers without essential insights as they navigate crucial decisions.

The solution, of course, is sound money.

Gold and silver.

While you can't control how this government shutdown will impact the economy, you can prepare your portfolio to fight against the impact to your wealth.

While gold is breaking records with all-time highs, silver is just hitting its stride.

Less than $2 from its all-time high, the profit potential is vast.

Silver offers similar benefits to gold as a hedge against economic volatility, yet the lower entry point makes it much easier to take advantage of the stampeding bull market rally.

In September, silver surged 15%—marking its strongest monthly advance in more than two years—building on an 11% gain in August and a further 1.5% increase in July.

That puts silver up roughly 50% for the year... and still climbing.

So, what's the most cost-effective way to buy silver right now?

Junk Silver.

That is, 90% silver pre-1965 dimes, quarters, half dollars, etc.

The unique benefits of Junk Silver:

- Finite supply

- Highly divisible

- Insanely low premiums

The best part... junk silver is currently available BELOW SPOT PRICE.

To secure your silver now, give the ASI team a call at 1-800-831-0007 or email us today.